Embedded financing platform that empowers your customers

Glider platform makes it easy to offer financing solutions to your customers within your workflow.

Fully integrated fintech infrastructure

We bring together everything needed to build the next generation of financial services that are digital first, compliant and customer cerntric. Use our out-of-the box solutions or co-create solutions tailored for your customers.

Omni-channel Application

In your store, on your website, in your app or via APIs.

Know Your Customer (KYC)

Verification with Transunion, Equifax, Socure and more.

Fraud Detection

Prevent synthetic, third-party, and other forms of organized fraud.

Data Enrichment

Over 1000 data points analyzed in loan decisioning engine.

Multi-lender Underwriting

Support for rules-based underwriting per lender.

Risk Scoring & Pricing

Flexible risk scoring and pricing of every application.

Embedded e-signature

Fully electronic document management with DocuSign.

Disbursements

Configurable fund flow to your business or to your customer.

Monitoring & Analytics

Loan products and Portfolio performance

Customer & Merchant Support

Trained and passionate customer support team.

Contact Us

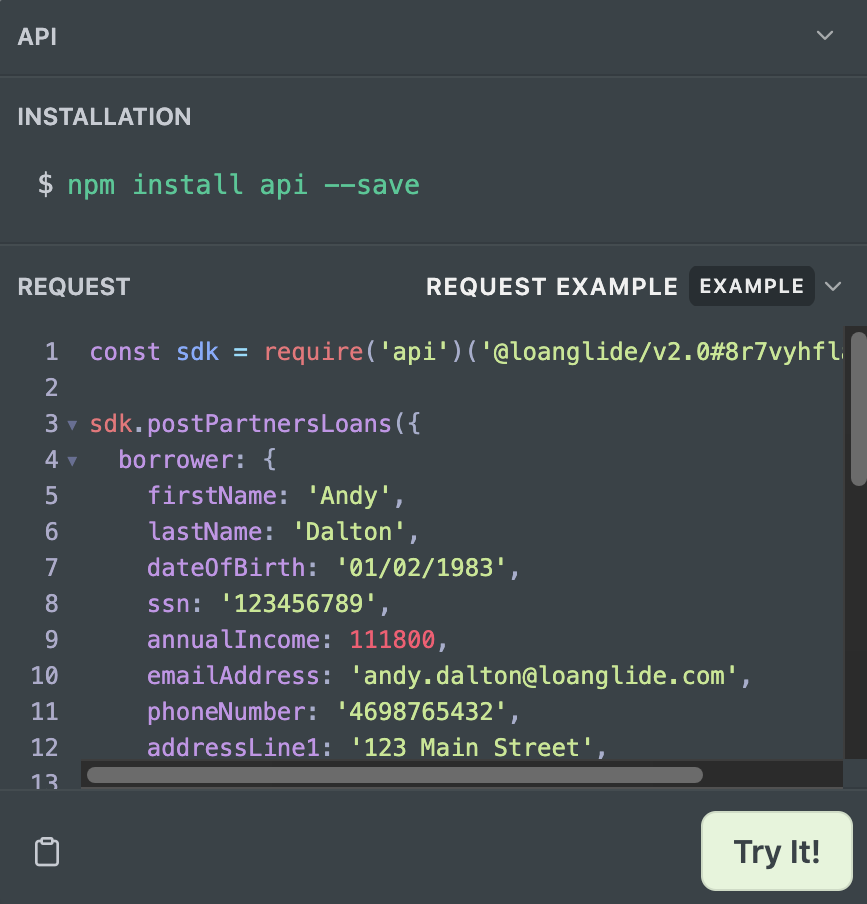

Developers love us too

Glider’s APIs are designed by engineers for engineers. Our focus on developer tools ensures that complex workflows are broken down into simple commands enabling you to launch solutions in weeks not months.

Embeddable Components

Integrate our loan payment calculators and checkout widgets into your website or e-commerce store with simple code snippets.

Extensive API

Every user interaction from loan creation to e-Sign can be programmed with our APIs.

Webhooks

Get real-time updates on Loan lifecyle, funding, on-boarding and payments with our webhooks capability.

Scalable

Cloud-based infrastructure that can grow with you so you can grow from hundreds to millions with no down-time.

Why businesses partner with Glider?

Increase GMV

When you offer financing to your customers, you can potentially increase your GMV by 20%

Increase loyalty

Increasing affordability results in repeat usage. Repeat customers means recurring revenue.

Grow your sales

By removing financing as a barrier enables customers to purchase more increasing Average Order Value (AOV) and ultimately sales.

Brand recognition

With our fully customizable and white label solution, increase stickiness and brand recognition by offering higher value instantly.